Is anyone listening now?

Findings from our biennial research measuring the impact of pension communications

Innovative, independent research is foundational at Fuse, as we test hypotheses and build data sets designed to enable positive change in the Canadian pension industry. In service of that goal, we were pleased to publish the second edition of our flagship research into communications as a capability in 2024, partnering with 17 funds and administrators across the country to better understand communications strategies, structures and investments.

This work included a deep dive into the impact of pension communications on everyday Canadians – asking, is anyone listening to the communications we are investing in? We asked Canadians questions about pension awareness, engagement and value as part of our annual Fuse Financial Insights Survey; this study, fielded in April of 2024 by our partners at Angus Reid, surveyed a representative sample of 1,017 Canadians with a workplace pension plan and gave us data to compare to our inaugural research on this important topic, published in 2022.

Here’s what they had to say:

What we learned about AWARENESS

When asked how well they knew the details of their pension, 48% of Canadians surveyed reported they know this information well or very well; 33% were somewhat familiar and 20% had limited or no familiarity with this information. Awareness of specific topics was relatively consistent from 2022; if respondents were aware of pension plan details, it was mostly likely of their plans contribution rates and funded status.

Figure 1: Are you aware of your pension plans…

Source: Fuse Financial Insights Survey 2022; 2024

While 58% of respondents were open to learning more about their pension, we wanted to understand more about the 42% who were not interested. When asked why not, nearly 60% of respondents reported ‘trusting their pension has it under control’ as the reason.

This is a fascinating finding and may, for some organizations, validate either an optimistic view of the industry focus on building trust with stakeholders or a more pessimistic perspective that the overall awareness and education efforts of pension communications are not critical. In our view, if Canadians trust pensions to have it under control, they might also trust when we tell them why they should be more aware or educated about pension content – we encourage pension plans to leverage this trust as a strong foundation for broader engagement!

Figure 2: Why aren’t you interested in learning more about your pension?

Source: Fuse Financial Insights Survey 2024

We asked Canadians to tell us how often their pension plan communicates with them; Figure 3 details survey respondents’ perception of pension communication frequency.

Figure 3: How often does your pension communicate with you?

Source: Fuse Financial Insights Survey 2022; 2024

Over 93% of respondents who reported communication every few weeks, monthly or quarterly reported this frequency as sufficient. 78% of those who reported communication annually indicated the frequency was sufficient, while those who reported communication every few years (54%) and no communication (32%) reported lower rates of satisfaction with the frequency of communication activity. These 2024 results are almost identical to our 2022 findings.

Naturally, Annual Statements are most memorable for pension members, recalled by a slightly decreased 69% of survey respondents in 2024, followed by Annual Reports at 53% and Newsletters at 43%. We collected additional data in 2024 relating to webinar invitations, which were recalled by 14% of respondents.

Figure 4: Which of the following communications do you remember receiving about your pension?

* New data collected in 2024

Source: Fuse Financial Insights Survey 2022; 2024

What we learned about ENGAGEMENT

Overall, pension communications score highly on relevance – with respondents reporting pension communication to be relevant (52%) or very relevant (22%). However, respondents find pension communications relatively less engaging – with those surveyed reporting content to be engaging (28%) or very engaging (7%). These results are depressingly consistent between 2022 and 2024, highlighting the meaningful opportunity for pension communications teams to move this needle.

Figure 5: How relevant / engaging do you find the communication you receive from your pension?

Source: Fuse Financial Insights Survey 2022; 2024

Canadians understand the relevance of pension interactions when planning for retirement or making the decision to retire; however, there continues to be a low level of awareness of all other pension-relevant life events.

Figure 6: When would you be most likely to think about your pension?

Source: Fuse Financial Insights Survey 2022; 2024

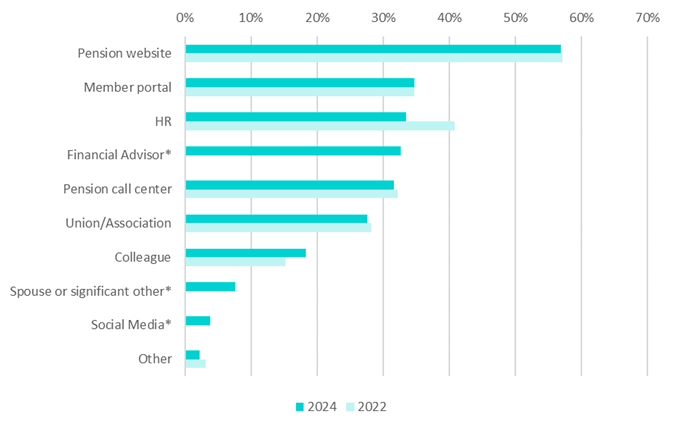

Canadians ranked pension websites as the most used source of pension information in 2024, followed by member portals (which gained position over employer Human Resources departments); while we can’t definitively explain this change from 2022, it may have been influenced by a reduction in the relative complexity of HR enquiries from the pandemic era or the continued enhancement of pension websites and improving content and clarity. We continue to believe communications teams cannot underestimate the importance of relationships with stakeholders like employer and union representatives in amplifying their messages.

Given the increasing focus on retirement advice by pension organizations, we included Financial Advisor as a source of pension information in our 2024 study, and Canadians gave them a slight but immediate edge over pension call centers. This finding underscores the importance of reaching Canadians through the fiduciary, unbiased channels we have in place as pensions!

We also asked about social media as a source of pension information in our 2024 study; the low penetration of this channel reported by respondents is consistent with low awareness of pension content on social platforms. The interplay between these results will be interesting to watch as social media strategies at pension organizations mature.

26% of survey respondents had attended a virtual and 31% an in-person information session with their pension, with pension organization information sessions and employer hosted information sessions ranking as the most attended over training, union sessions and annual meetings.

Figure 7: Where would you turn for information about your pension?

* New data collected in 2024

Source: Fuse Financial Insights Survey 2022; 2024

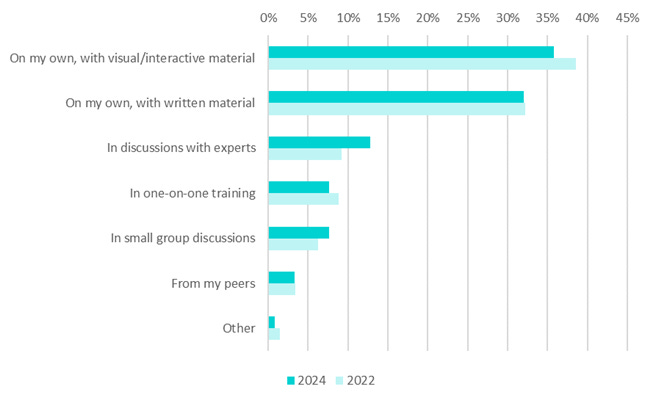

While survey respondents continued to indicate a strong preference to learn new things on their own, using either visual/interactive (36%) or written (32%) material; however, the preference for visual or interactive material decreased slightly from 2022 (by 3%) and the preference for ‘in discussion with experts’ increased slightly (by 4%). This is an interesting shift to watch in future studies, with implications for how organizations continue to invest in the channels and content leveraged to enable self-directed learning and self-service.

This pattern continues in data relating to survey respondent preferences for receiving information; while email and online, via self-services, continue to be the leading channel preferences, the latter experienced a material decrease in preference among survey respondents in 2024 (of 12%).

Figure 8: How do you prefer to learn new things?

Source: Fuse Financial Insights Survey 2022; 2024

Figure 9: I am most comfortable receiving information:

* New data collected in 2024

Source: Fuse Financial Insights Survey 2022; 2024

Over 70% of survey respondents did not recall seeing their pension in any form of media, with decreases in all categories of media in 2024 when compared to 2022. Social media continues to generate the most (if paltry) media awareness, at 11%.

This consistent pattern of decreasing awareness across channels is puzzling, when compared to the still tentative but increasing efforts of pension organizations in some of these arenas; one hypothesis is that, within financial topics, housing, inflation and the poor economy have taken up significant mindshare, helping to crowd out pension communications in the timeframe of our study. In 2022, we encouraged pension organizations to treat this ‘low profile’ as an opportunity to experiment and be creative with tactics and content; however, these persistent headwinds in overall awareness have us inclined to sound a more serious alarm about the consistent effort required to reach stakeholders.

Figure 10: Do you see your pension on:

Source: Fuse Financial Insights Survey 2022; 2024

What we learned about VALUE

26% of survey respondents indicated that their pensions’ brand was important to them, while 74% said brand was not important – these results are identical between our two instances of this research. When asked if their pension had a positive impact on society, a whopping 62% of survey respondents were unsure (also consistent with prior years’ findings) – implying a significant and continuing opportunity to educate members on the value of pension plans.

Figure 11: My pension has a positive impact on society.

Source: Fuse Financial Insights Survey 2024

Personal financial concerns continued to dominate the rankings by survey respondents asked about the most important thing about their pension. Interestingly, fairness, a focus of plan design dialogues, and transparency, often a driver of the comprehensive nature of our communications, continued to rank among the least important elements to Canadians.

Figure 12: To me, the most important thing about my pension is that it is:

Source: Fuse Financial Insights Survey 2022; 2024

We once again asked Canadians what additional things a pension could do for them that they would value, as part of our ongoing investigation of how the pension value proposition should evolve; this question offers perspective for communications professionals seeking insight into where to create content and engage stakeholders as well. 35% prioritized calculators and 34% prioritized access to data, self-service experiences which would be arguably more effective with a strong narrative that communications should inform. A meaningful number of survey respondents were open to financial advice on pensions (30%) and financial advice on overall finances (27%) from their pension, indicating an interest in personalized financial education; this year, in response to industry trends, we included ‘other advice to support my retirement’, an option that was prioritized by 19% of respondents. These findings are consistent with the slight trend in preference away from self-service learning toward engagement with experts.

Figure 38: What additional things could your pension do for you that you would value?

* New data collected in 2024

Source: Fuse Financial Insights Survey 2022; 2024

The most notable thing about these results is how little they have changed in the two years since our first study: communications in the pension industry is a very long game. If you believe it is critical for pension stakeholders to better understand – and value – their plans, significant effort and long-term consistency will be required to achieve this goal. Although it may seem daunting, we remain excited about the opportunity for to improve the impact of pension communication; there is clearly consumer need and scope for creativity in this effort.

How do you think pension communications can improve? We’d love to hear your ideas at hi@fusestrategy.co.