Is anyone listening?

Measuring the impact of pension communication

Recently, Fuse conducted an in-depth research study of Communications as a capability in the pension industry; in partnership with nine Canadian pension investment boards and administrators, we explored communications strategy, priorities and positioning, and developed a view of how participating firms are organized and operating.

We believe Communications is emerging as a critical capability in the pension industry – and an area of opportunity and innovation. But we also wanted to learn, how impactful are the industry’s communications efforts so far?

So we asked Canadians. We surveyed a representative sample of 1,040 Canadians with a workplace pension plan as part of the Fuse Financial Insights Survey, to gauge the impact of pension communications. The survey was conducted among members of the Angus Reid Forum in October 2022 and the findings provide a clear view of the nascent impact of pension industry communications overall. We hope it provides a valuable comparison to internal analytics and inspires bold communication plans.

What we learned about AWARENESS

37% of Canadians surveyed reported they are very familiar with the details of their pension; 50% were somewhat familiar and 13% were not at all familiar. Respondents were most familiar with their plans contribution rates and funded status.

While 39% were not interested, 61% of respondents were open to learning more about their pension.

Figure 1: Are you aware of your pension plans…

Source: Fuse Financial Insights Survey 2022

Naturally, Annual Statements are most memorable for pension members, noted by 73% of survey respondents who recalled any form of communication, followed by Annual Reports at 53% and Newsletters at 41%.

Figure 2: Which of the following communications do you remember receiving about your pension?

Source: Fuse Financial Insights Survey 2022

Overall, pension communications score highly on relevance, but poorly on engagement.

Figure 3: How relevant / engaging do you find the communication you receive from your pension?

Source: Fuse Financial Insights Survey 2022

Canadians understand the relevance of pension engagement when planning for retirement or making the decision to retire; however, there is a low level of awareness of all other pension-relevant life events. Respondents volunteered annual communication, death of a spouse, when making long-term care decisions, and when making collective bargaining / strike decisions as other moments to consider pension impacts.

Figure 4: When would you be most likely to think about your pension?

Source: Fuse Financial Insights Survey 2022

What we learned about ENGAGEMENT

Canadians ranked pension websites as the most used source of pension information followed, not by member portals or pension call centers, but by their employer Human Resources departments. Communications teams cannot underestimate the importance of relationships like those with employer and union representatives in amplifying their accurate information and key messages.

Figure 5: Where would you turn for information about your pension?

Source: Fuse Financial Insights Survey 2022

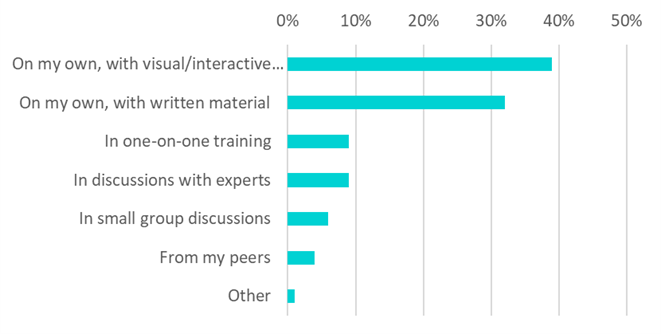

Survey respondents indicated a strong preference to learn new things on their own, using either visual/interactive (39%) or written (32%) material. This finding has significant implications – and opportunities – for communications and member services more broadly, as the member imperative continues to trend toward self-directed learning and self-service.

Figure 6: How do you prefer to learn new things?

Source: Fuse Financial Insights Survey 2022

This insight is further validated by survey respondent preferences for receiving information; a combined 73% identified online self-service and email as their preferred channels.

Figure 7: I am most comfortable receiving information:

Source: Fuse Financial Insights Survey 2022

While the largest percentage of survey respondents (59%) had not recalled seeing their pension in the media, it is worth noting that social media made the largest impression at 16%. There is freedom to experiment in pension communications – the best-case scenario is someone will notice!

Figure 8: Do you see your pension on:

Source: Fuse Financial Insights Survey 2022

What we learned about VALUE

26% of survey respondents indicated that their pensions’ brand was important to them, while 74% said brand was not important. When asked if their pension had a positive impact on society, a whopping 64% of survey respondents were unsure – implying a significant opportunity to educate members on the value of pension plans.

Figure 9: My pension has a positive impact on society.

Source: Fuse Financial Insights Survey 2022

Personal financial concerns dominated the rankings by survey respondents asked about the most important thing about their pension. Interestingly, fairness, a focus of plan design dialogues, and transparency, often a driver of the comprehensive nature of our communications, ranked as least important to Canadians.

Figure 10: To me, the most important thing about my pension is that it is:

Source: Fuse Financial Insights Survey 2022

We asked Canadians what additional things a pension could do for them that they would value, as part of our ongoing investigation of how the pension value proposition should evolve; however, this question offers insight for communications professionals seeking insight into areas to create content and engage stakeholders as well.

A meaningful number of survey respondents were open to financial advice on pensions (33%) and financial advice on overall finances (30%) from their pension, indicating an interest in personalized financial education. 36% prioritized calculators, which would be arguably more effective with a narrative or gamified experience that communications should inform. 23% indicated a preference for investments that are consistent with their personal values, which opens a door to engage differently with stakeholders to understand those values as well as tell the story of how pension activities may or may not align, and why.

Figure 11: What additional things could your pension do for you that you would value?

Source: Fuse Financial Insights Survey 2022

We’re excited about the opportunity for to improve the impact of pension communication; there is clearly consumer need and scope for creativity in this effort.

Can our research be helpful to your planning? We’d be happy to share. You can contact us at hi@fusestrategy.co to learn more.

"When asked if their pension had a positive impact on society, a whopping 64% of survey respondents were unsure" -- what a stat! Room for improvement indeed. Thank you for these fantastic insights.